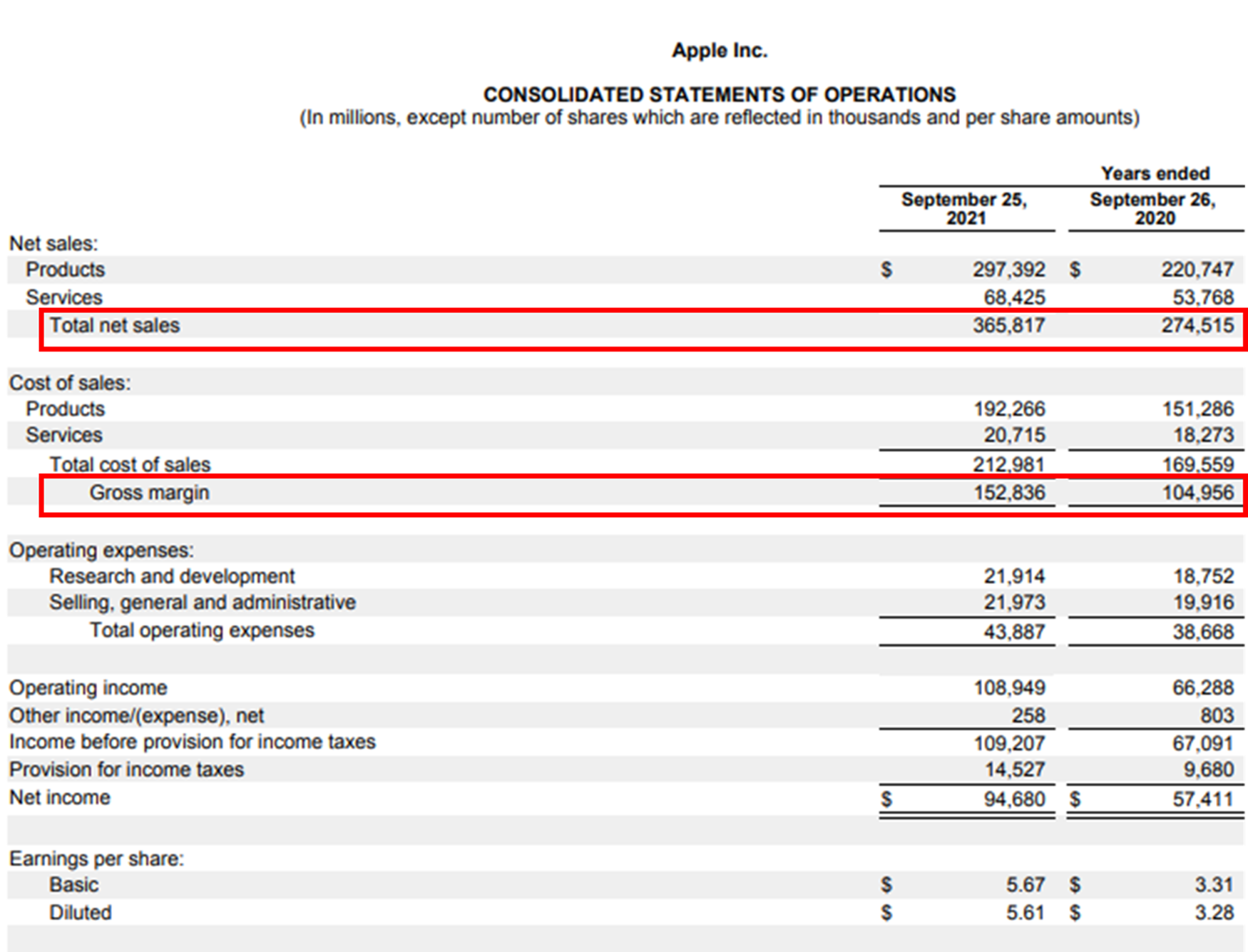

Revenue is the amount of money generated by a business from sales of its goods or services.

Revenue, or total sales, is the total money earned and recognized by the business from its normal operations (i.e, selling its all products and services). It’s also referred to as ‘top line’ because it appears at the top of a company’s income statement.

can be calculated as: No. of units sold x the price per unit

If you’re a service-based business, you may need to use billable hours or service packages sold for calculating your revenue.

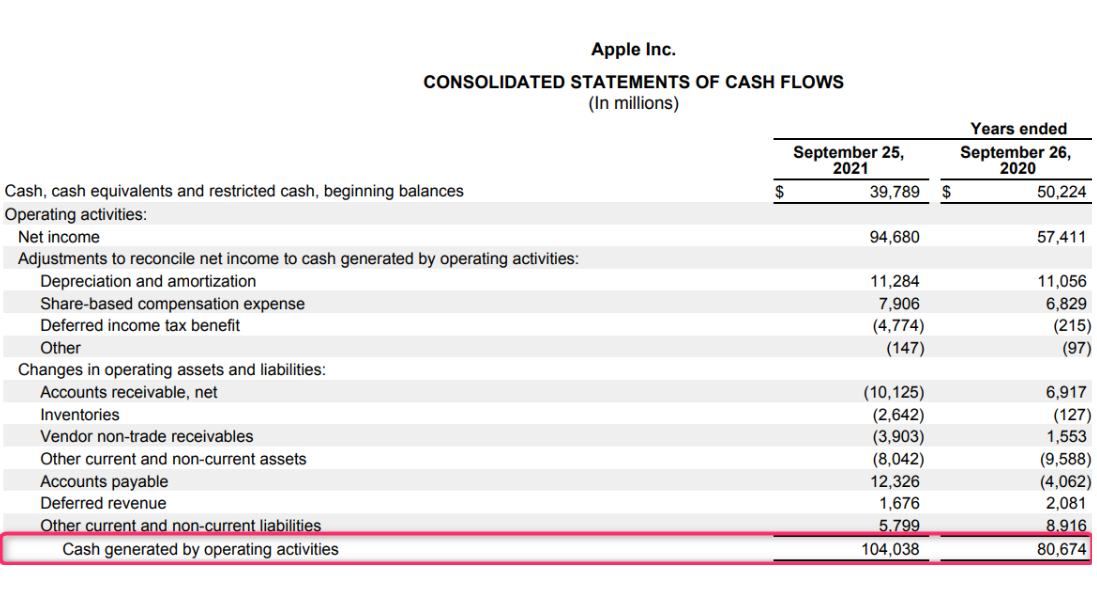

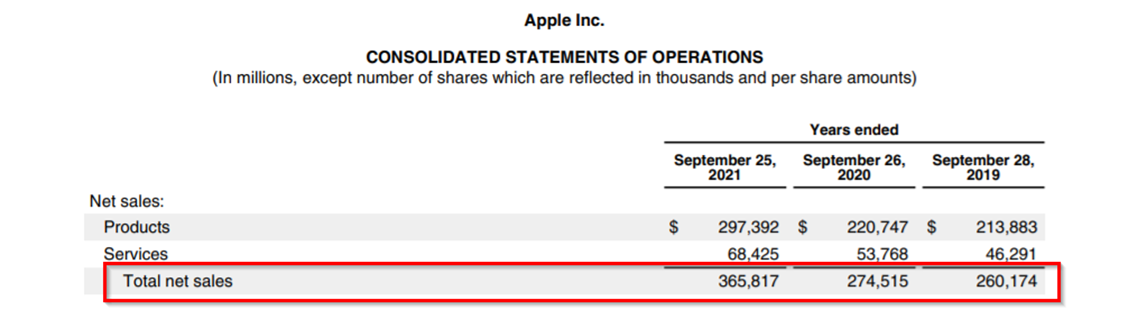

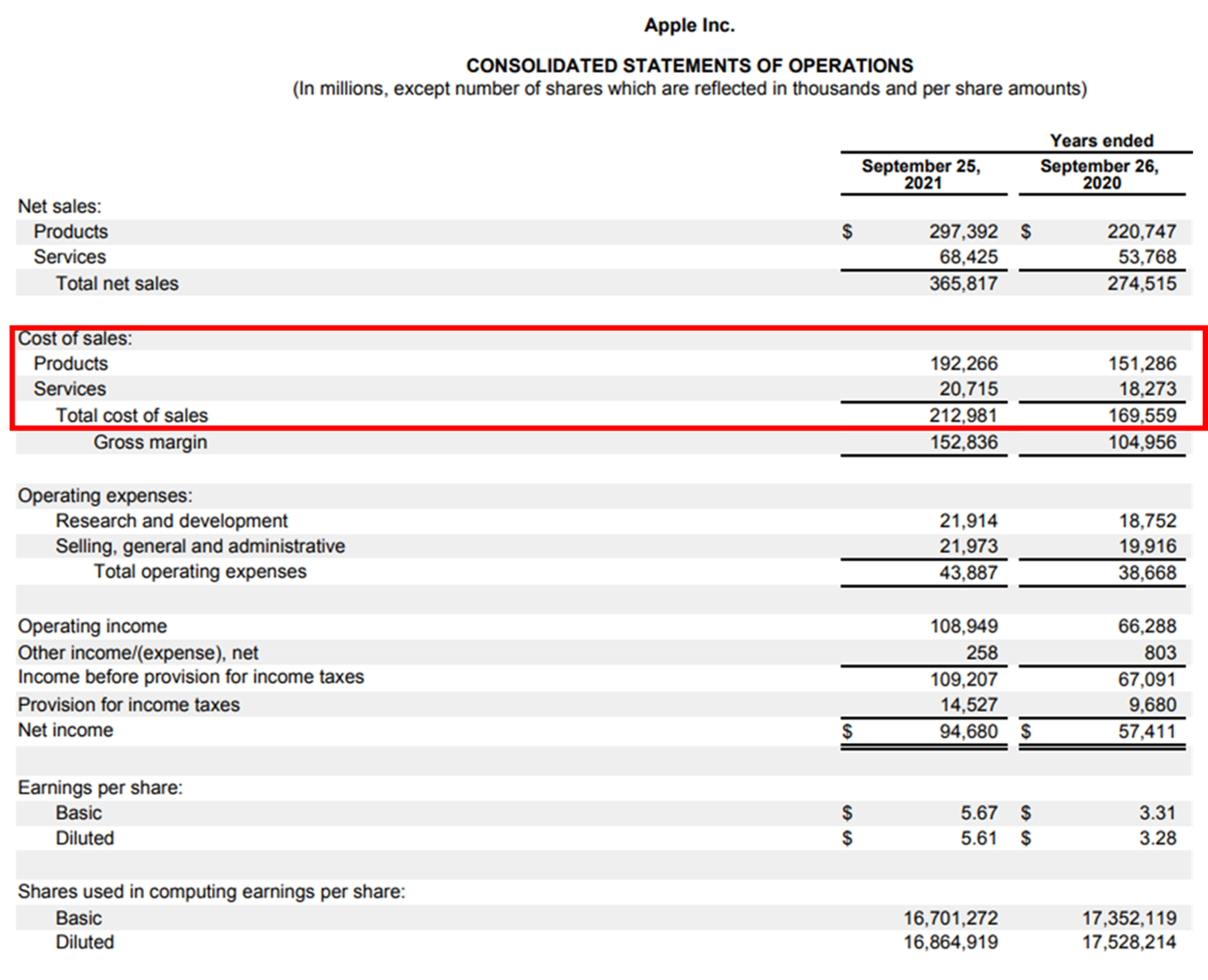

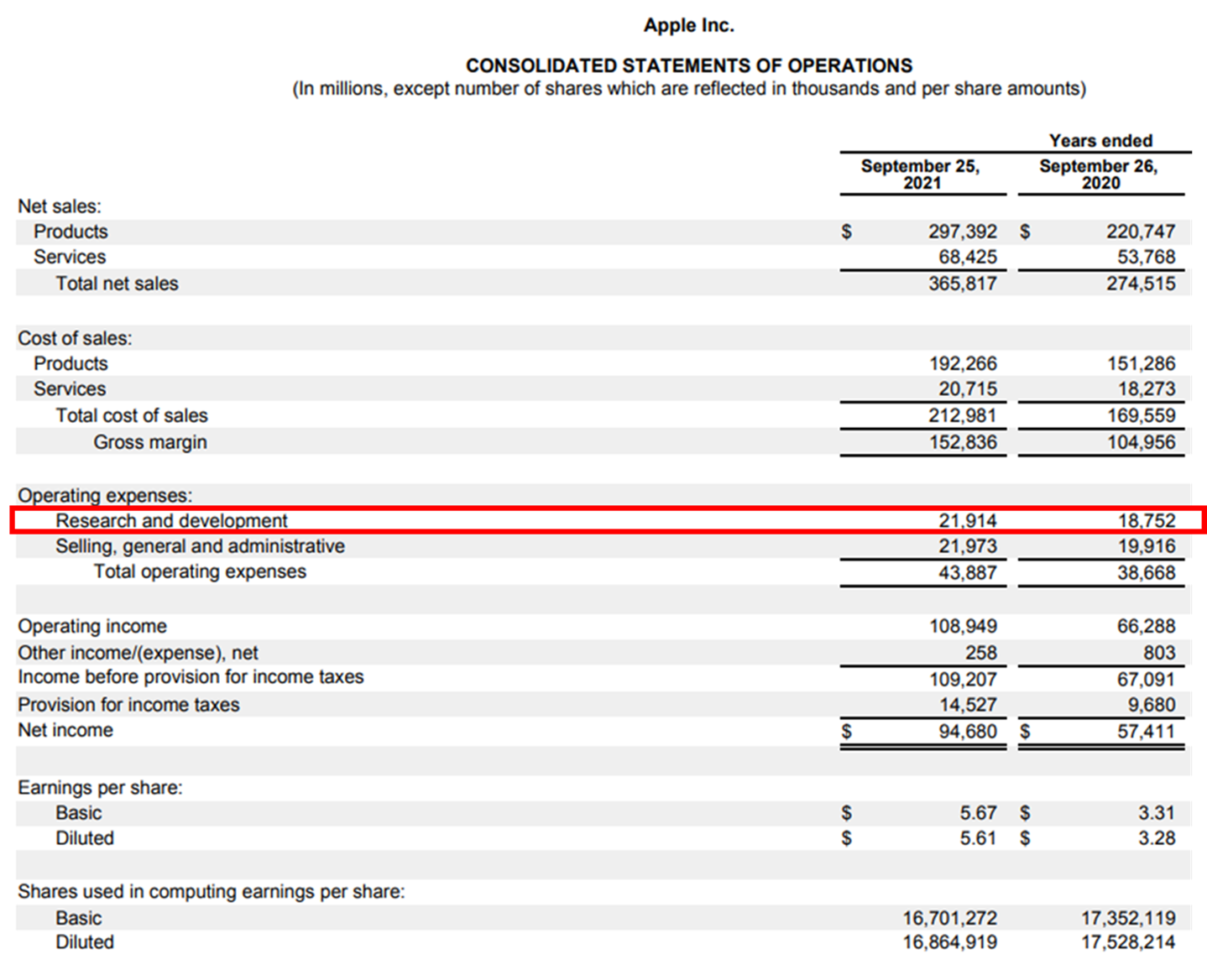

Apple sells both, products as well as services, and calculates its revenue as such on the income statement. As you can see, Apple’s revenue for the period ending September 2020 is $274.51 billion and for period ending September 2021 is $365.81 billion:

Source: Apple’s SEC filing 10K

EBITDA (short for Earnings Before Interest, Taxes, Depreciation, and Amortization) is the income of a company before factoring in the four expenses: Interest, Taxes, Depreciation and Amortization.

EBITDA is a measure of a company’s profitability. While it’s not legally required to be disclosed on the financial statements, you can compute it using the information on a company’s financial statements.

EBITDA is especially useful when assessing distressed companies that have a negative net income. The EBITDA figure allows stakeholders or a party considering a leveraged buyout to assess if the company can generate positive income from its operating.

However, it’s important to note that EBITDA overlooks the cost of debt and the business’s reinvestment needs.

Even though you might not find EBITDA explicitly computed on a company’s financials, you can compute it yourself.

EBITDA is calculated as: Net Income + Interest + Taxes + Depreciation + Amortization

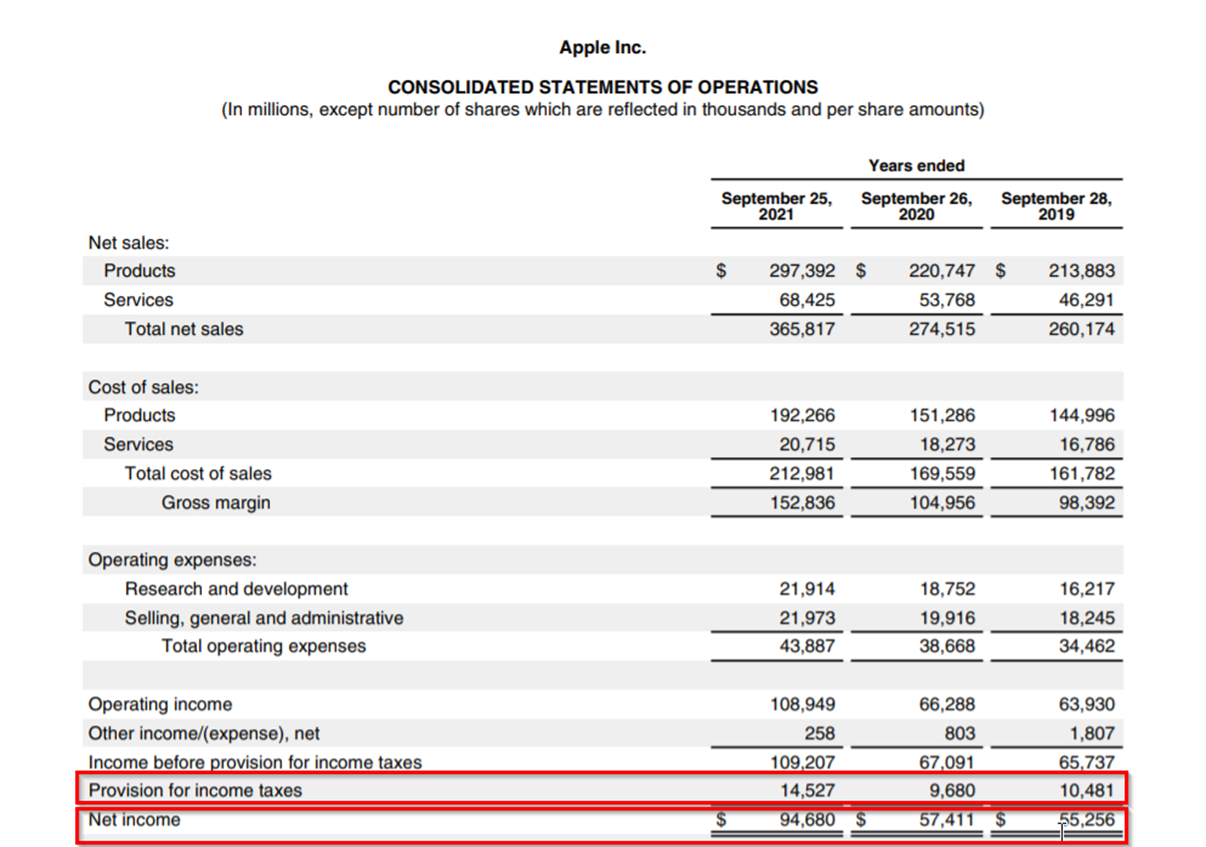

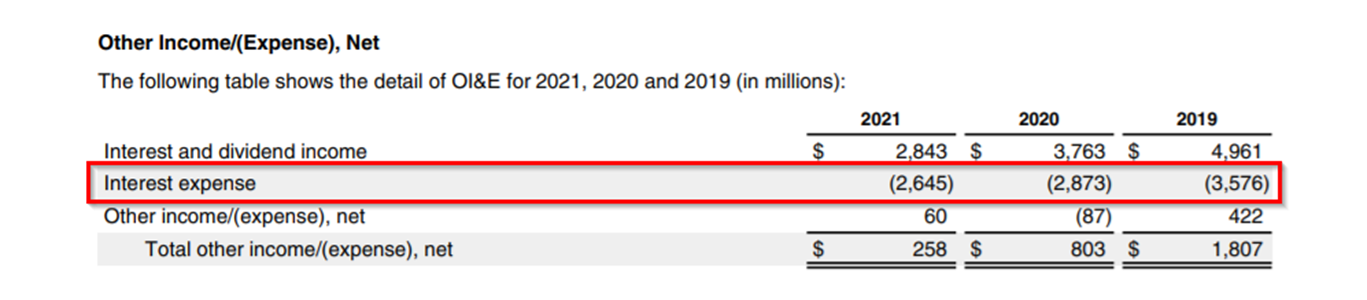

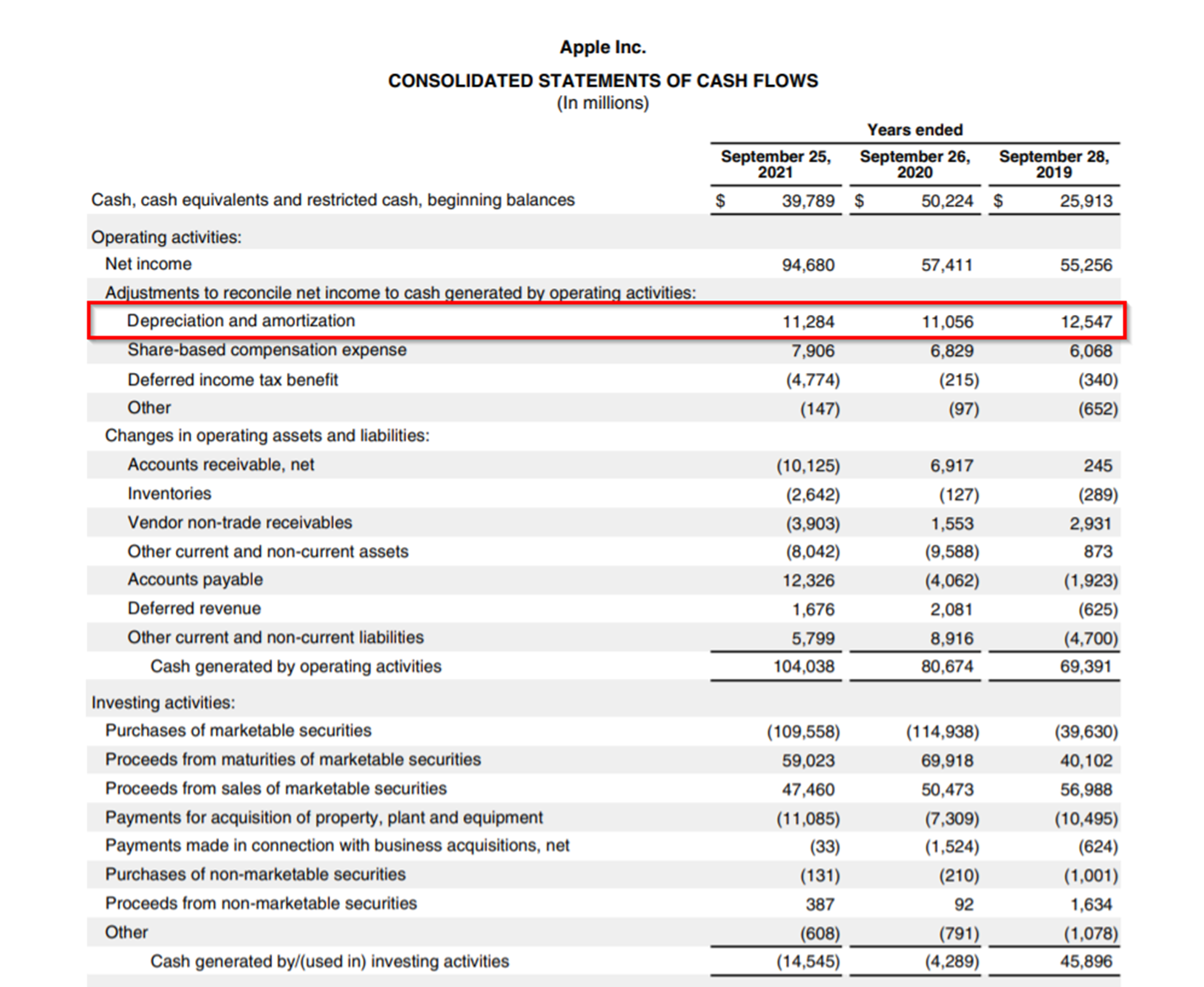

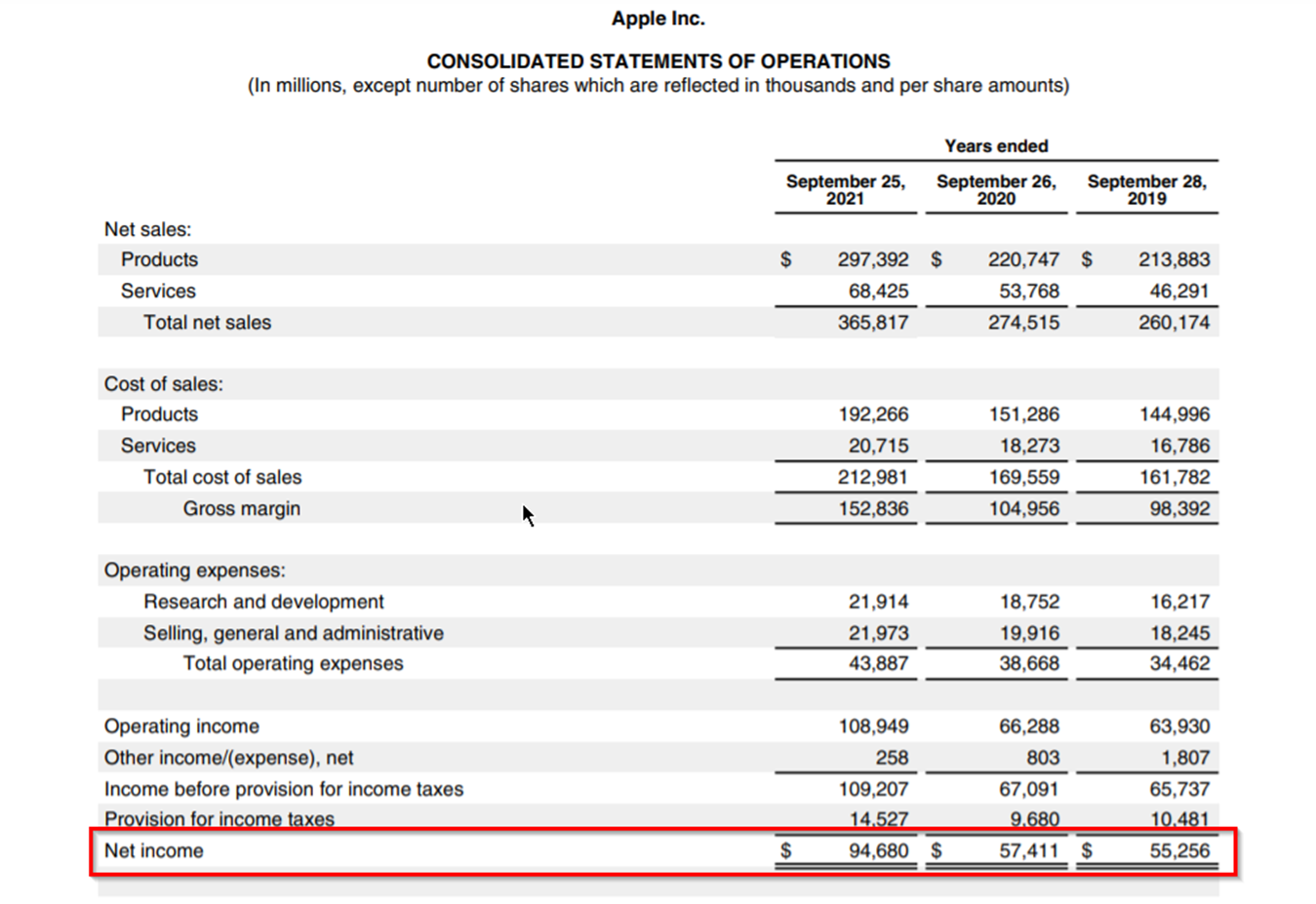

Let’s take Apple for instance. To compute Apple’s EBITDA for the period ending September 25, 2021, you’ll need the following figures as illustrated on Apple’s income statement and cash flow statement:

Source: Apple’s SEC filing 10K

Source: Apple’s SEC filing 10K

Source: Apple’s SEC filing 10K

Therefore, the EBITDA for the period ending September 25, 2021 is:

$94,680 (Net Income) + $2,645 (Interest Expense) + $14,527 (Provision for taxes) + $11,284 (Depreciation and Amortization) = $123,136 (EBITDA)

Net Income is the total revenue generated by a company reduced by all expenses, including taxes.

Net Income is the company’s profit as calculated after reducing the revenue with all operating and non-operating expenses. Net Income is the amount of money that belongs solely to the company’s equity and preference shareholders.

It’s also known as the bottom line since it appears at the bottom of the income statement.

Net Income = Total Revenue – Total Expenses

As you can see on Apple’s income statement that the company’s Net Income for the period ending September 2020 is $57.41 billion and for period ending September 2021 is $94.68 billion:

Source: Apple’s SEC filing 10K

Cost of Revenue/Cost of Goods Sold refers to the total cost incurred by a business for manufacturing a product and delivering the finished goods or rendering a service to the customers.

Cost of Revenue/Cost of Goods Sold is the total cost incurred by a business for manufacturing and delivering products and/or services to the customers. It is also known as Cost of Sales. It includes all direct costs, such as:

Cost of Revenue/Cost of Goods Sold = Opening Inventory + Cost of Production + Overheads + Marketing Cost + Distribution Cost - Closing Inventory

As you can see, Apple’s Total Cost of Revenue/Cost of Goods Sold/ Total Cost of Sales for the period ending September 2020 is $169,559 and for the period ending September 2021 is $212, 981.

The direct cost incurred by a business towards research and development of an improved or a new product, service, process, or technology is known as the Research and Development Cost.

Research and Development cost is incurred towards discovering and implementing new knowledge to enhance the existing product, service, processes, or current technology substantially or to design a new one.

It includes

Research and Development Costs = Costs directly attributable to research and development

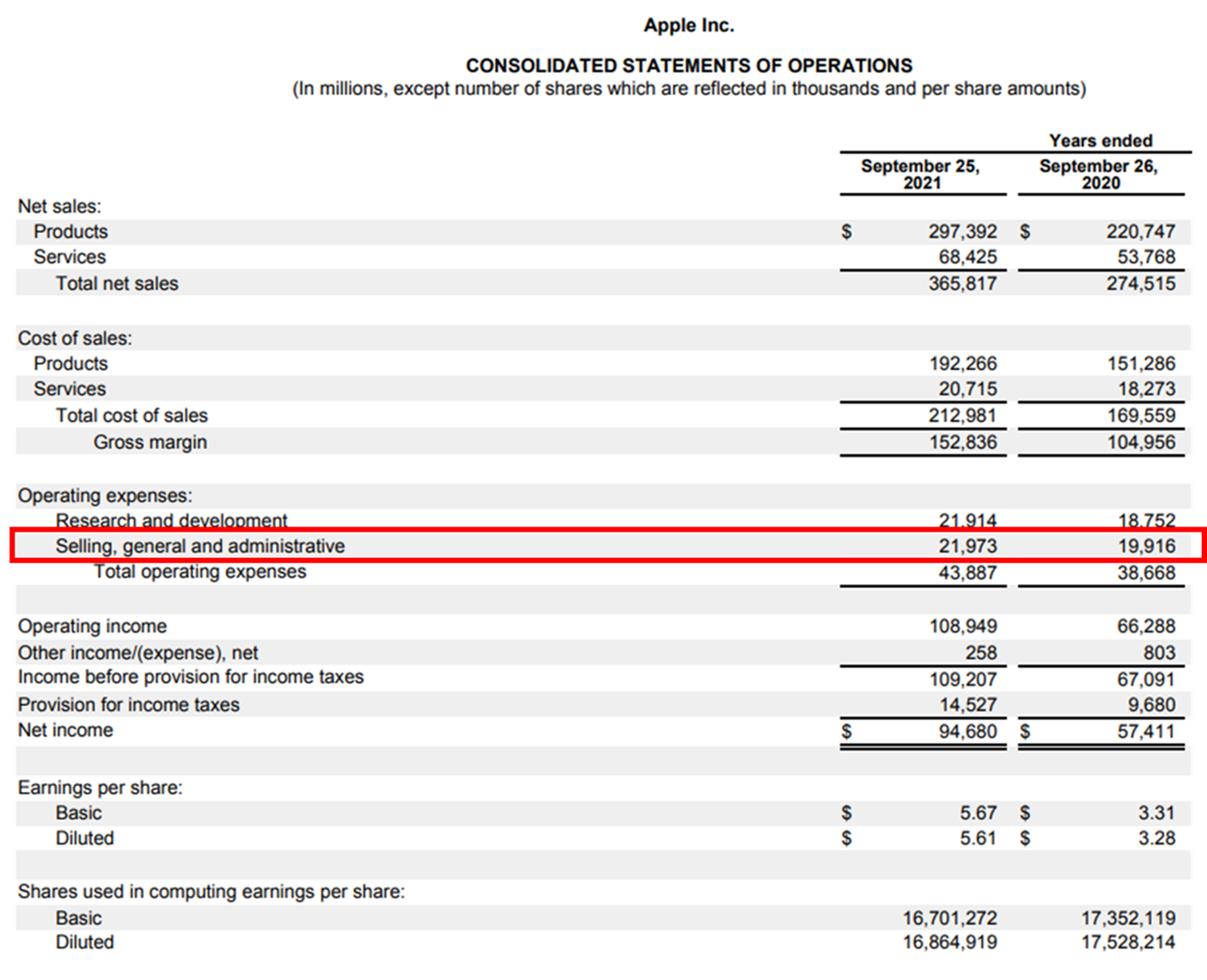

Selling, General, and Administrative expenses are the day-to-day expenses that cannot be associated with a product or a service directly but are quintessential for managing the business.

These costs cannot be attributed to a particular product or service and are not a part of the Cost of Goods Sold. It includes expenses such as:

Selling, General, and Administrative Expenses = Selling Expenses + General and Administrative Expenses

Selling, General and Administrative Expenses of Apple for the period ending September, 2020 is $19,916 and for the period ending September, 2021 it is $21,973, as can be observed.

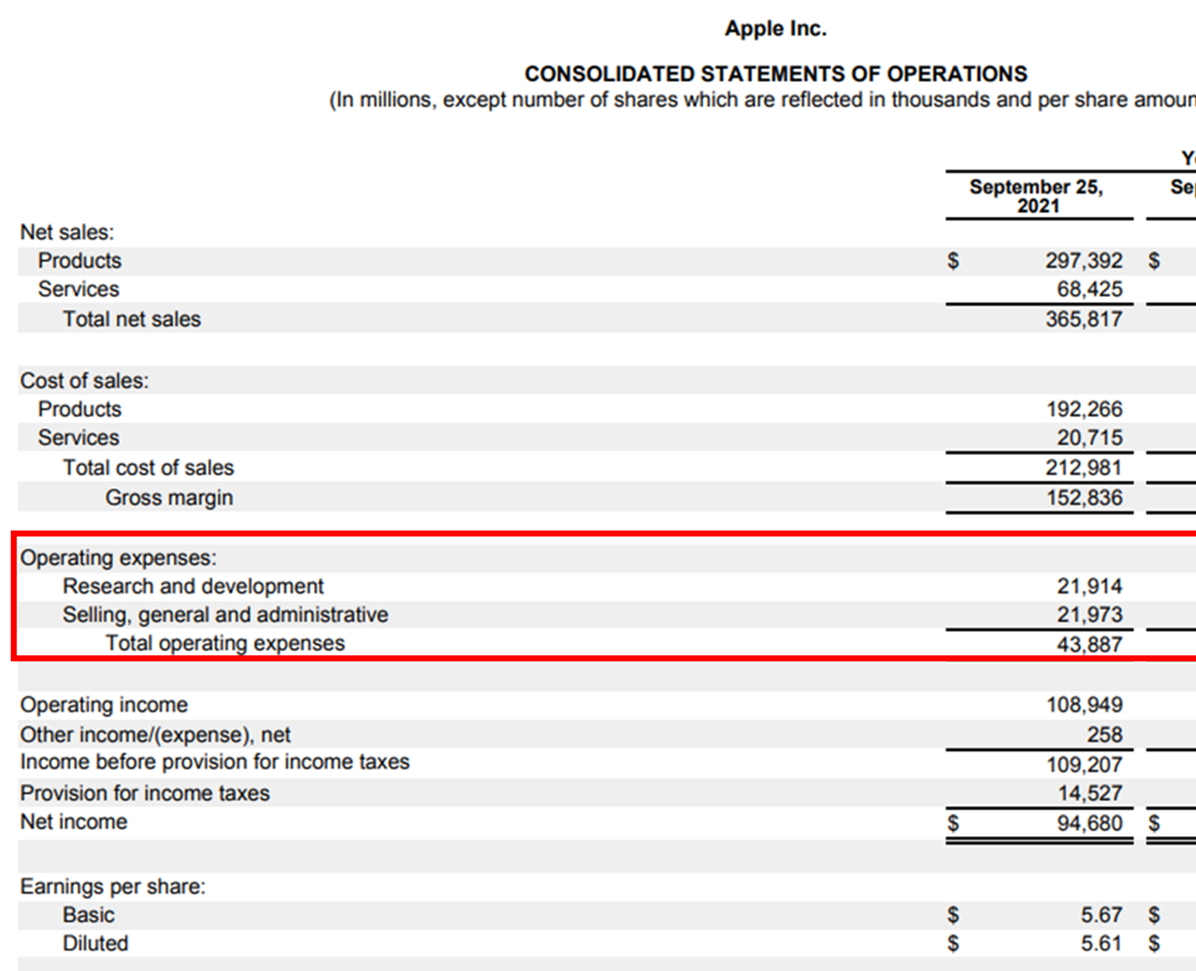

The expenses incurred to by a business for running its day-to-day operations are called Operating Expenses.

Day to day expenses directly attributable to operations, and not production, such as

Total Operating Expenses = Salaries + Rent + Commissions + Utilities + Other Operating Expenses

As you can see, the Total Operating Expenses of Apple for the period ending September 2020 is $38,668 and for the period ending September 2021 it is $43,887.

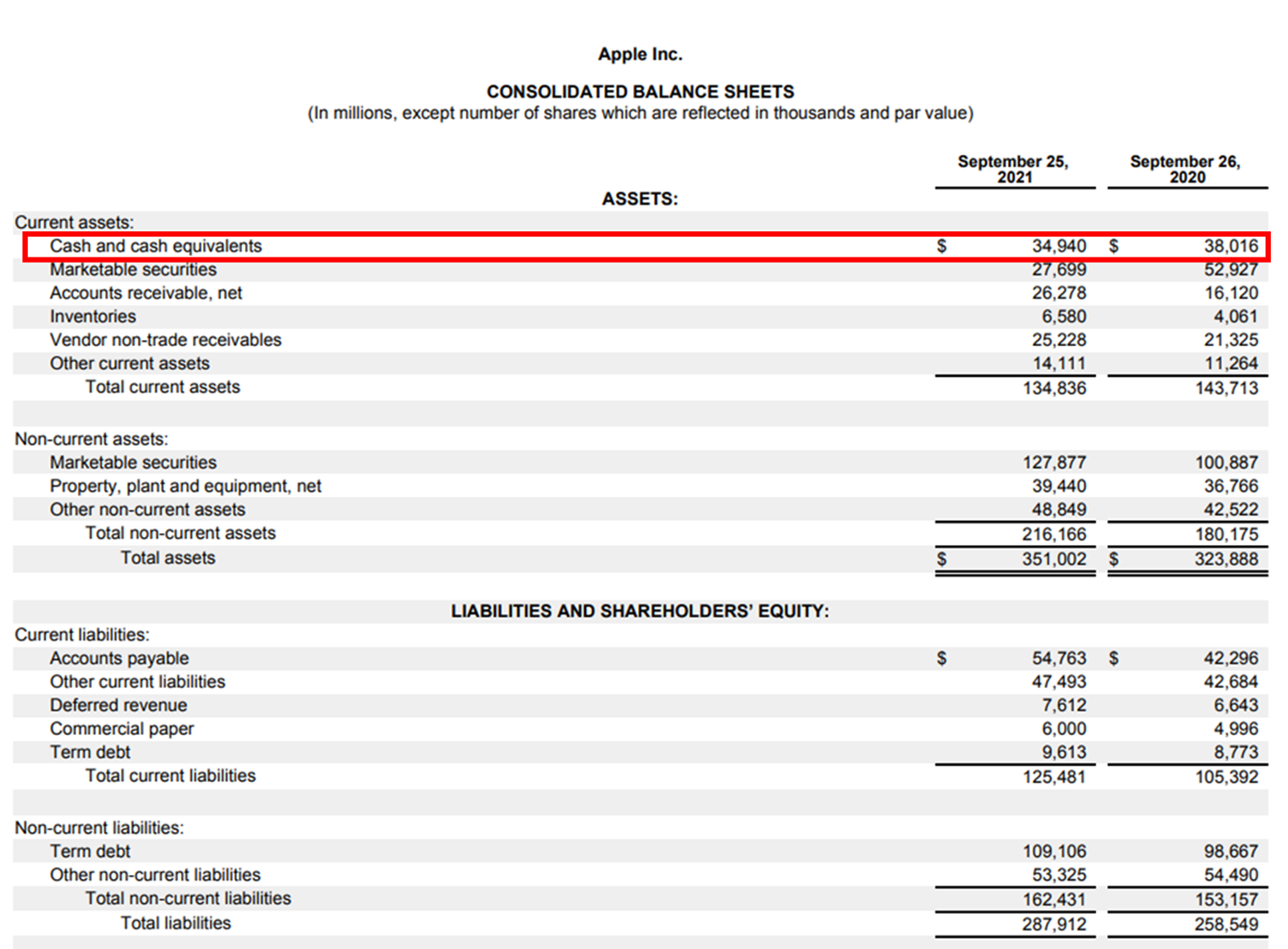

Cash and cash equivalents appear under the section Current Assets on the balance sheet and refer to cash or assets that are readily convertible into cash.

Cash or liquid assets with a maturity of 90 or fewer days are called cash and cash equivalents. It includes

Cash and Cash Equivalents = Cash (Bills + Coins + Currency notes) + Cash equivalents (Bank Drafts + Cheques + Short-term Investments + Government Bonds + Bank Accounts - Bank Overdrafts)

Cash and Cash Equivalents of Apple for the period ending September, 2020 is $ 38,016 and for the period ending September, 2021 it is $34,940, as can be seen.

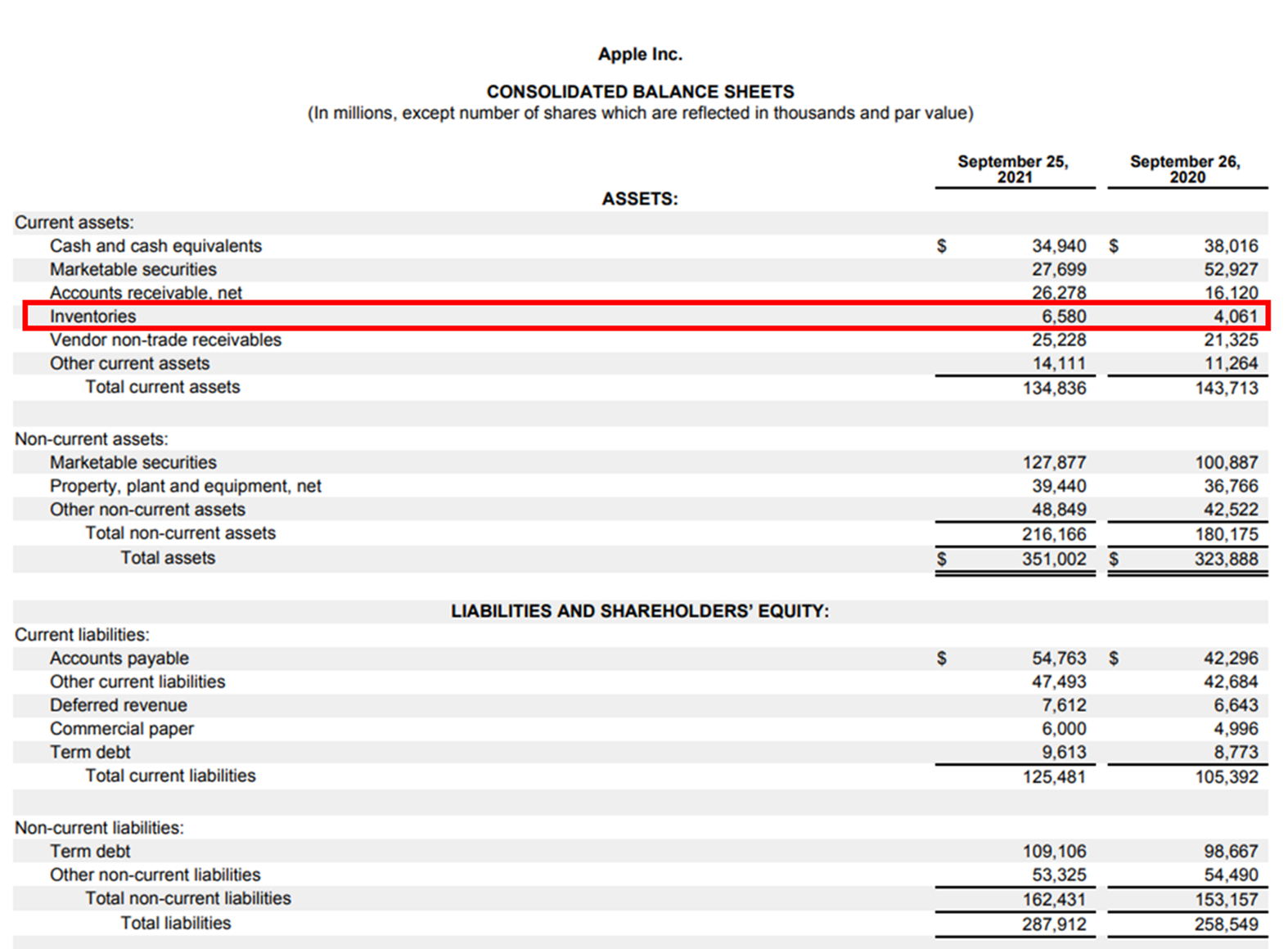

Inventory is the total value of raw materials, work-in-progress goods, and finished goods held by the company at a given time.

Inventory includes goods and items held by a business with an intention to earn a profit out of it. Essentially, an asset can be called inventory when:

The above definition is relevant for a trading entity. Manufacturers have one more item that can be termed as inventory — the raw materials.

Closing Inventory = Opening Inventory + Net Purchases - Cost of Goods Sold

Apple’s inventory balance for the period ending September 2020 is $4,061, and for the period ending September 2021 it’s $6,580.

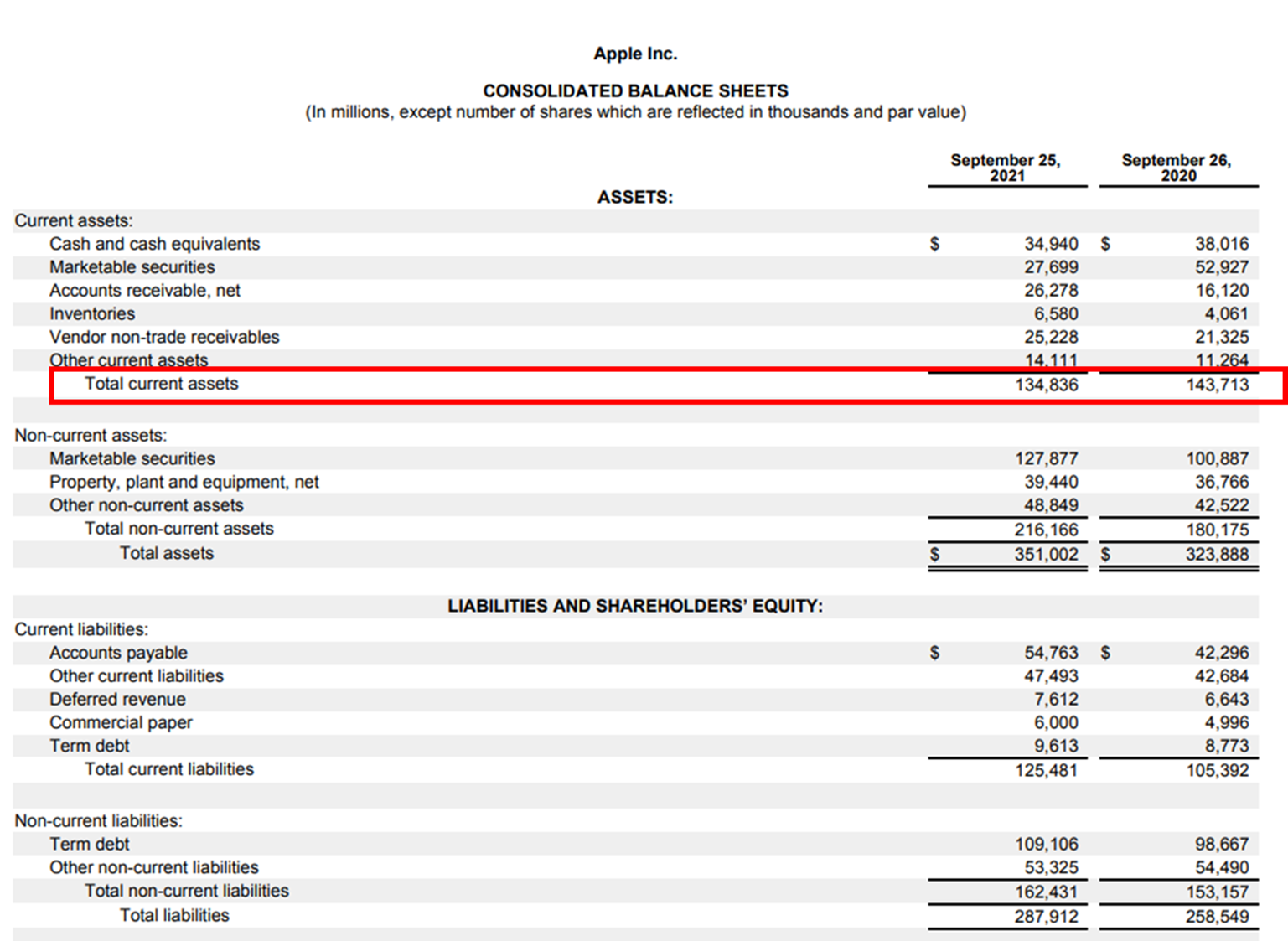

Current assets are those assets that a company can convert into cash in the short term.

Current assets include liquid assets that are easily convertible into cash in the short term. Examples of current assets include:

Total Current Assets = Cash + Cash Equivalents + Accounts Receivables + Inventory + Other Liquid Assets

Apple’s Total Current Assets for the period ending September 2020 are $143,713 and they’re $134,836 for the period ending September 2021.

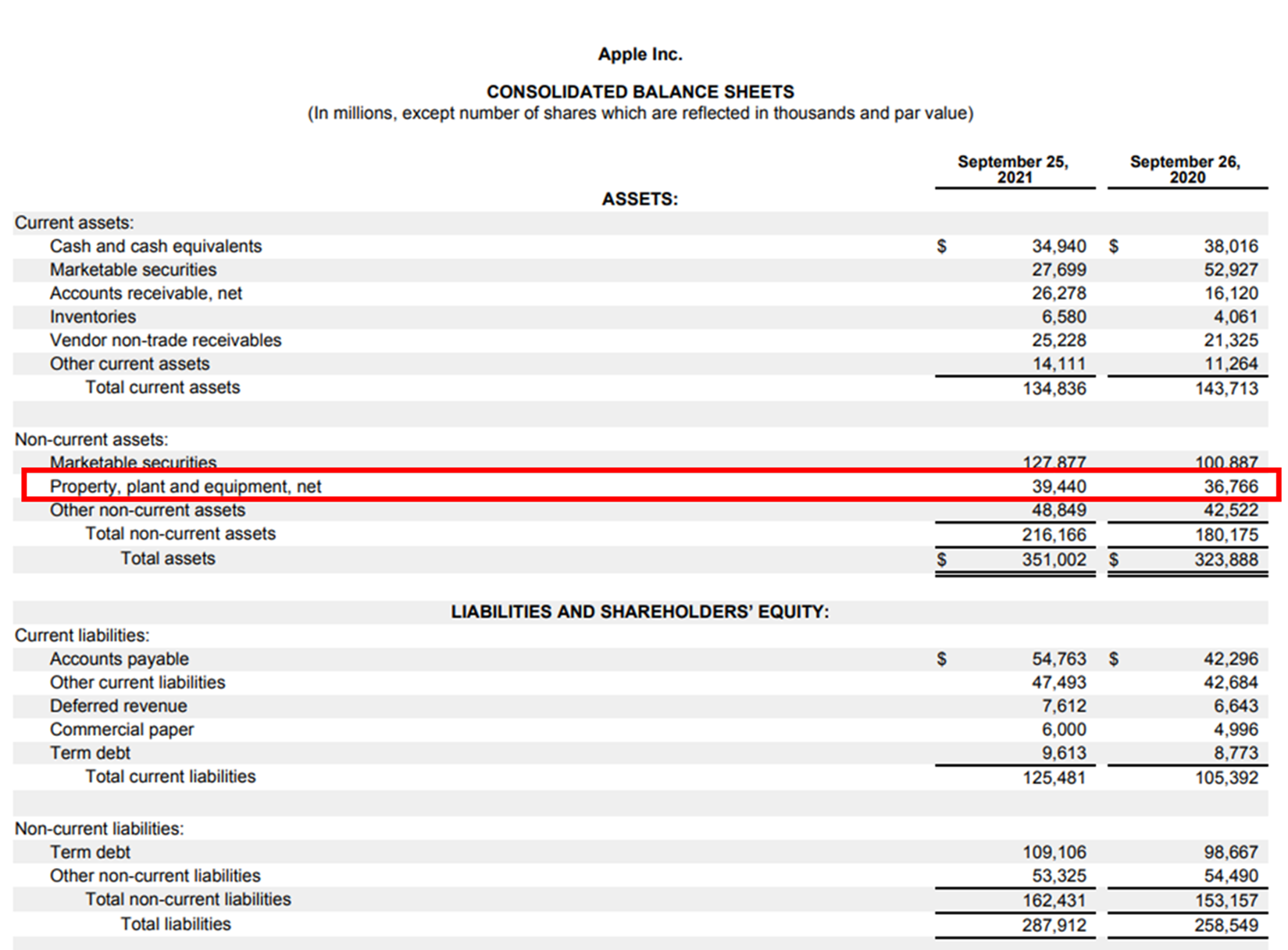

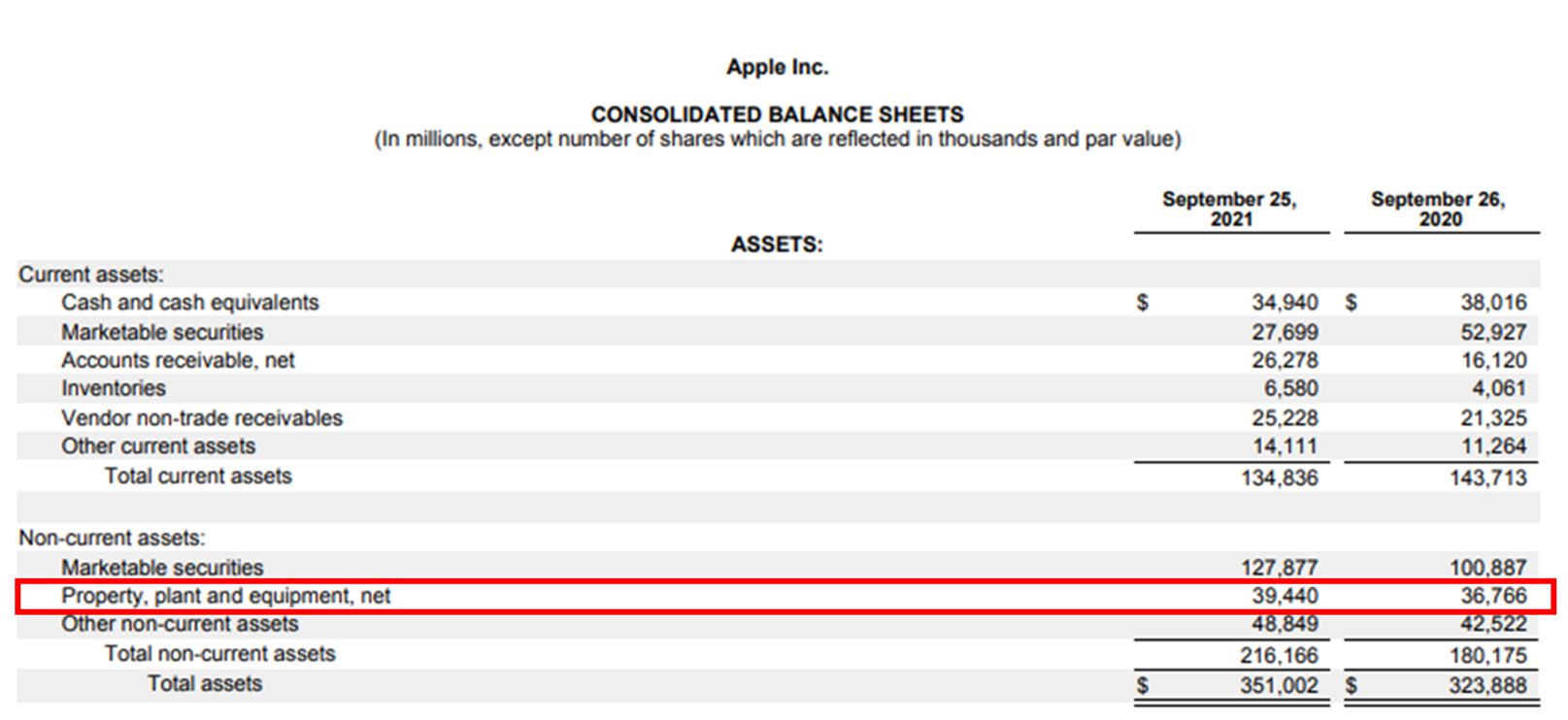

Property, Plant, and Equipment are fixed assets that a company uses for its business for the long-term.

Property, Plant, and Equipment are fixed assets that a business requires for its day-to-day operations. Unlike current assets, Property, Plant, and Equipment can’t be converted into cash in the short term. Examples of Property, Plant, and Equipment include:

Property, Plant and Equipment = Land + Machinery + Building + Computers + Other Fixed Assets

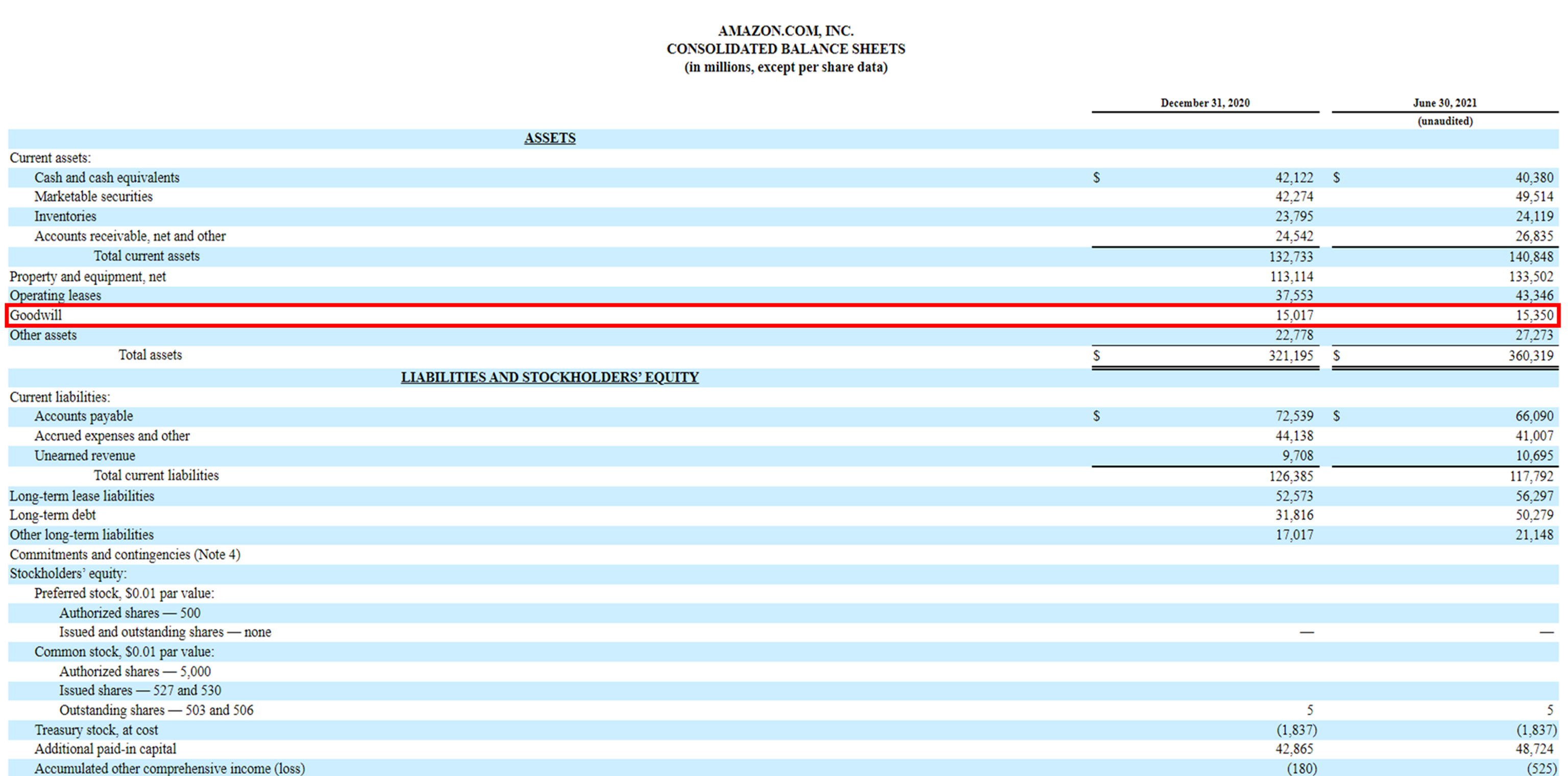

Goodwill is an intangible asset generated as a result of acquiring another business.

Goodwill is the amount paid for acquiring a company in excess of its fair market value. Since you can’t touch or feel Goodwill, it’s an intangible asset that represents the premium paid for acquiring a company. It’s amortized over time until it disappears from the company’s balance sheet.

Goodwill = Purchase Consideration Paid for Acquiring a Business - Fair Market Value of the Business Acquired

For instance, Amazon’s Goodwill for the period ending December 2020 is $15,017 and $15,350 for the period ending June 2021.

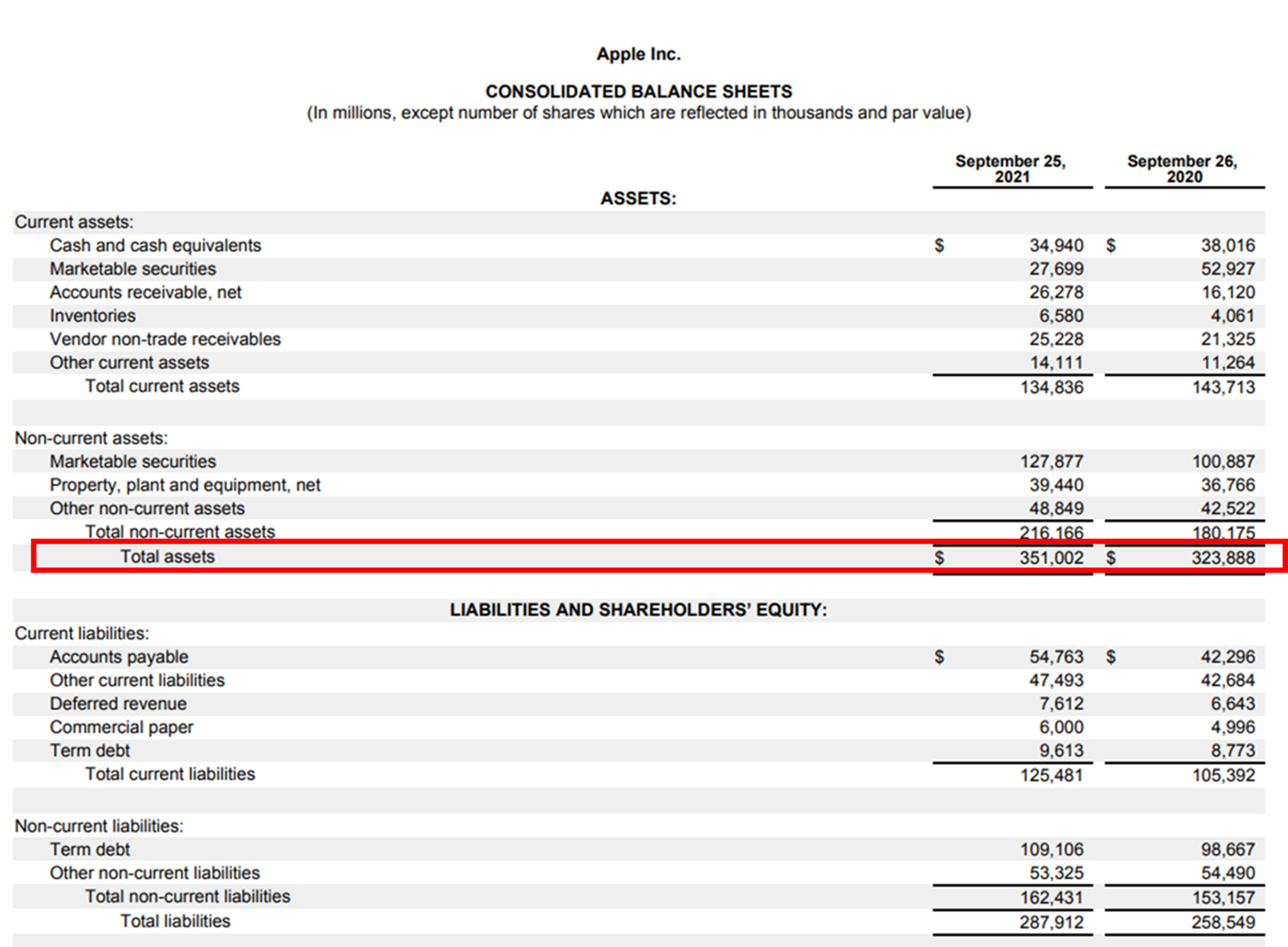

The summation of all assets, tangible or intangible, on a company’s balance sheet is called the Total Assets.

Assets are the application of capital through various sources of capital, both long and short term. For instance, when a company’s Accounts Payable balance increases, the company’s inventory balance increases as well. Effectively, the company uses credit offered by suppliers (source of capital) to buy inventory (application of capital).

Total Assets = Total Current Assets + Total Non-Current Assets

Apple’s Total Assets for the period ending September 2020 are $323,888 and $351,002 for the period ending September 2021.

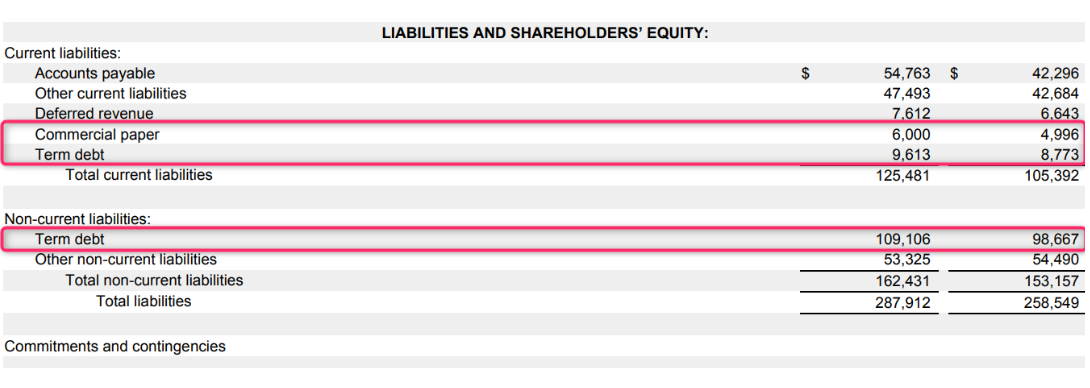

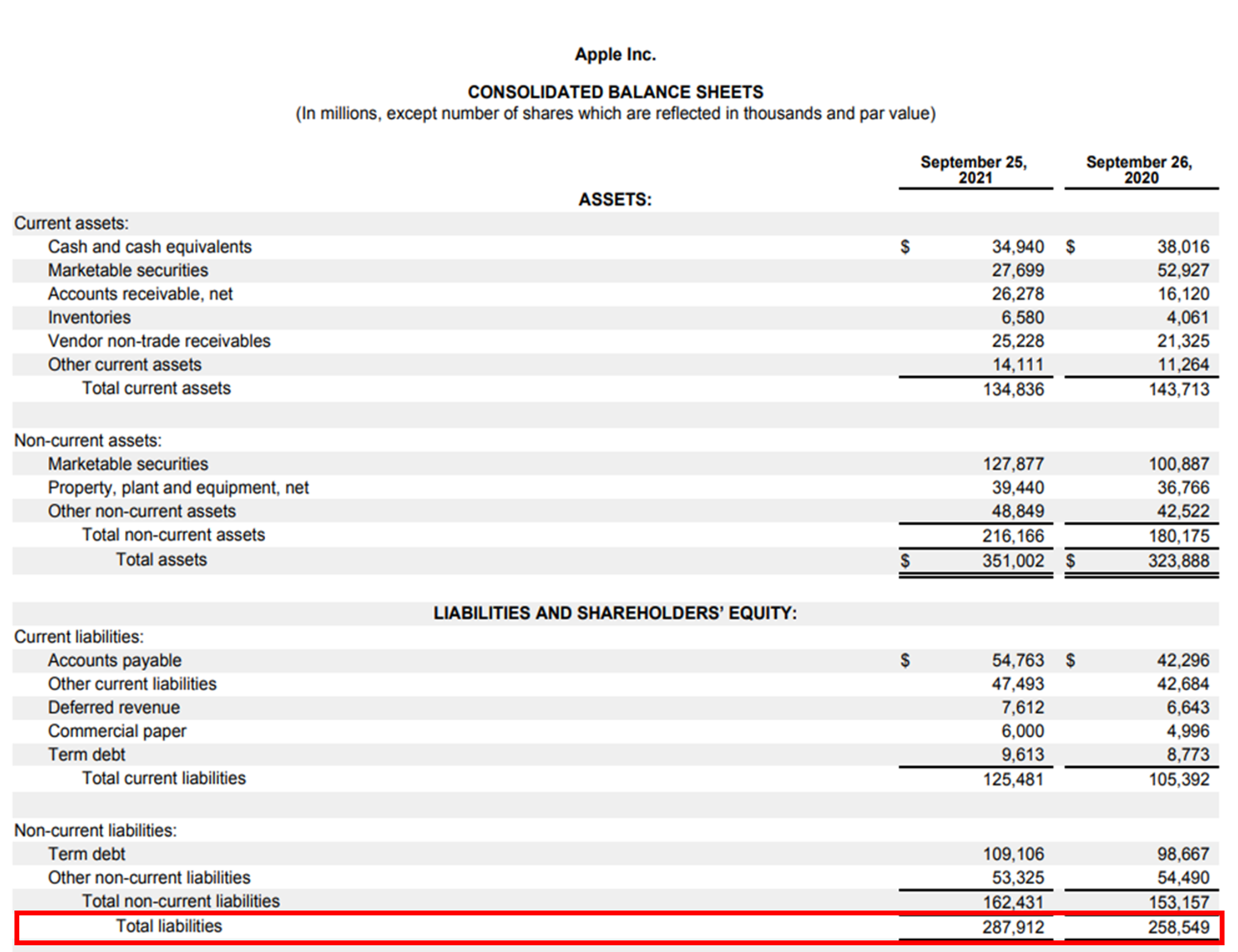

Total Liabilities is the total amount that a business is liable to pay to internal and external parties such as a contractor, employee, lender, or another business, among others.

It is the total of all debts and obligations owed by a business. They are cleared over a period of time through the transfer of money, goods, or services.

Liabilities include:

Total Liabilities = Total Assets - [Equity Share Capital + Preference Share Capital]

Apple’s Total Liabilities for the period ending September 2020 are $258,549 and $287,912 for the period ending September 2021.

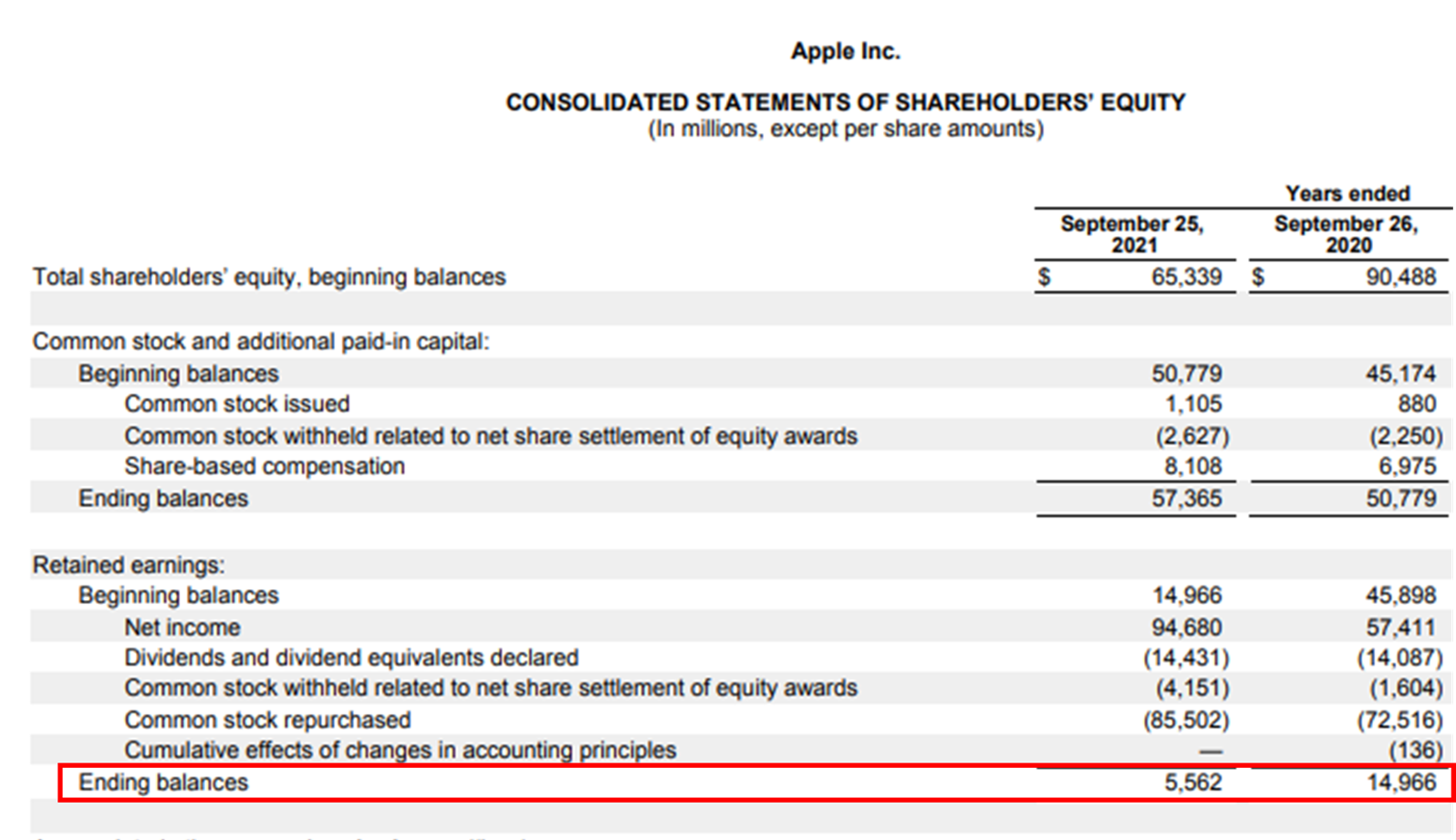

Retained Earnings are a part of the profit that is not distributed among shareholders and is reinvested into the business.

The part of the profit that is not distributed as dividends to the shareholders, but is reserved by a business for expansion, investment, working capital, or paying off debt is called retained earnings. These earnings are reinvested into the business to fuel the company’s growth or reduce the total debt.

Retained Earnings = Retained Earnings at the beginning of the year + Net Profit/(Net Loss) - Cash Dividends - Stock Dividends

As illustrated, Apple’s Retained Earnings for the period ending September 2020 is $14,966 and $5,562 for the period ending September 2021.

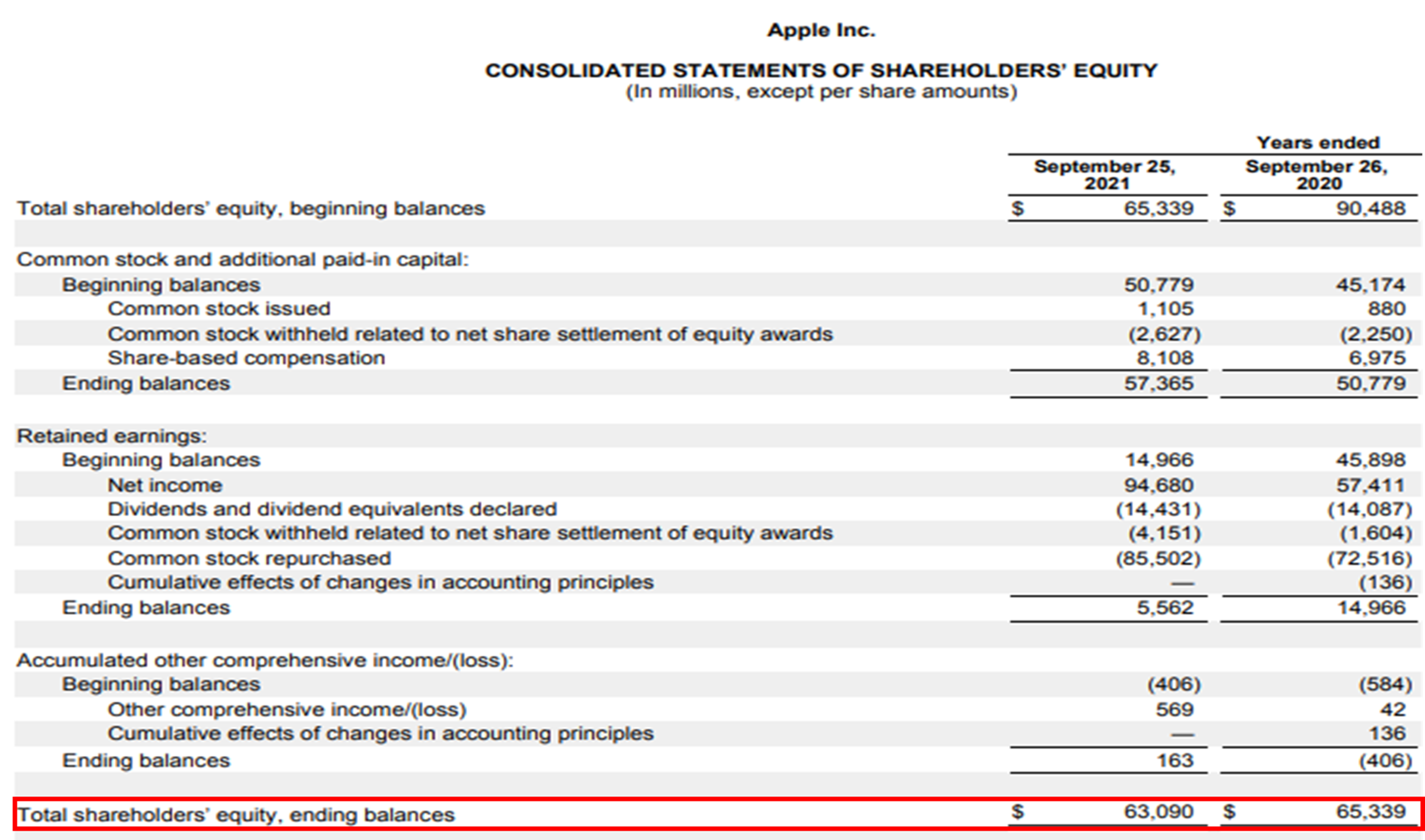

Total shareholders’ equity is the amount of money invested by its owners in the company, plus the retained earnings accumulated over time.

It represents the capital invested by the shareholders because it shows the book value of the business on a given date by subtracting the book value of liabilities from the book value of assets owned by the company.

It includes:

Total Shareholder Equity = Total Assets - Total Liabilities

As seen, Apple’s Total Shareholder Equity for the period ending September 2020 is $65,339 and $63,090 for the period ending September 2021.

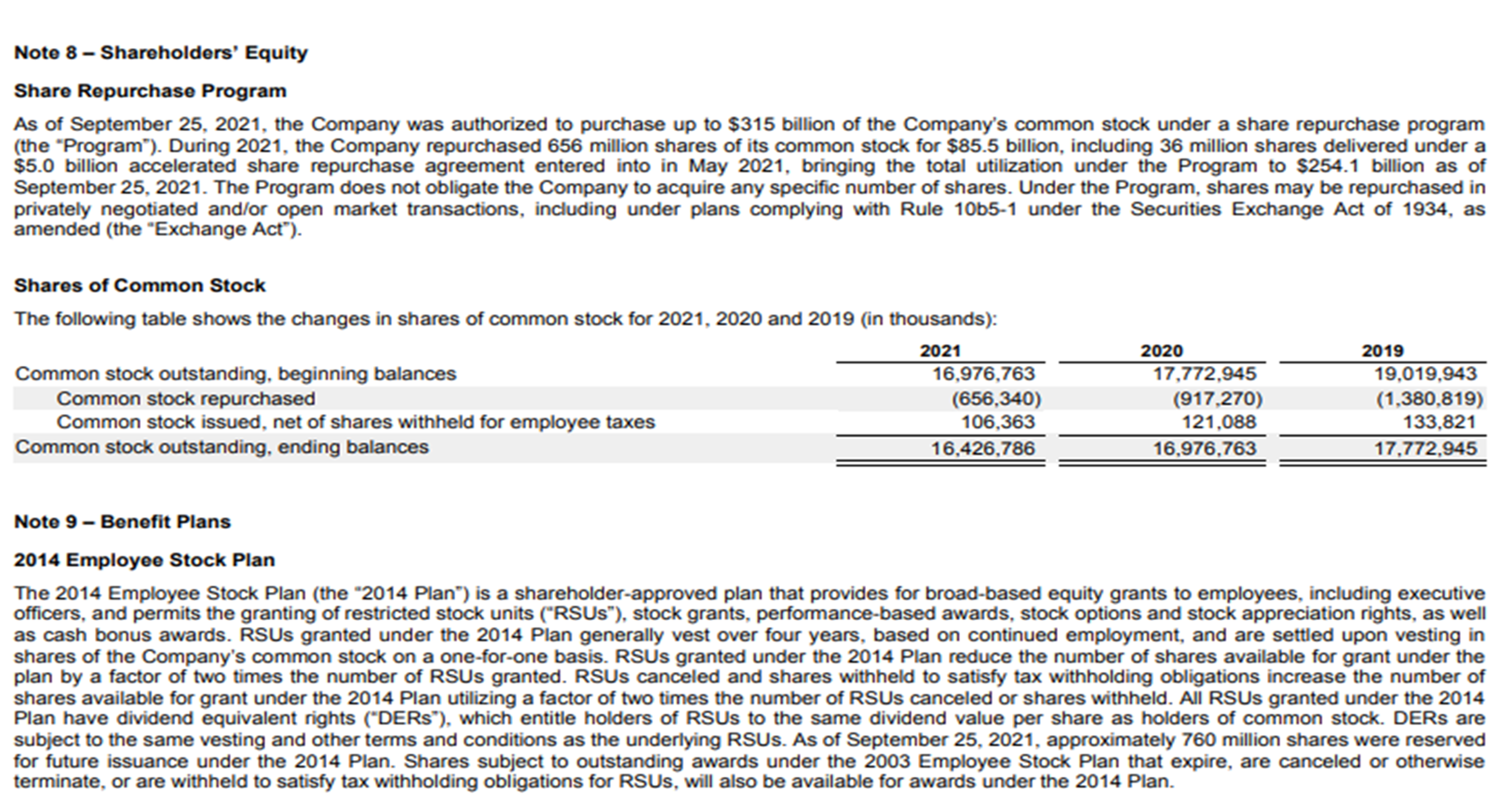

Common Stock Outstanding is the number of equity shares issued and held by shareholders.

Common Stock Outstanding is the total shares issued by a company, excluding treasury shares. It’s a metric used for calculating market capitalization and earnings per share of a company.

Common Stock Shares Outstanding = Number of Common Shares Outstanding - Number of Treasury Shares

Apple’s Common Stock Outstanding for the period ending September 2020 is $16,976,763 and $16,426,786 for the period ending September 2021.

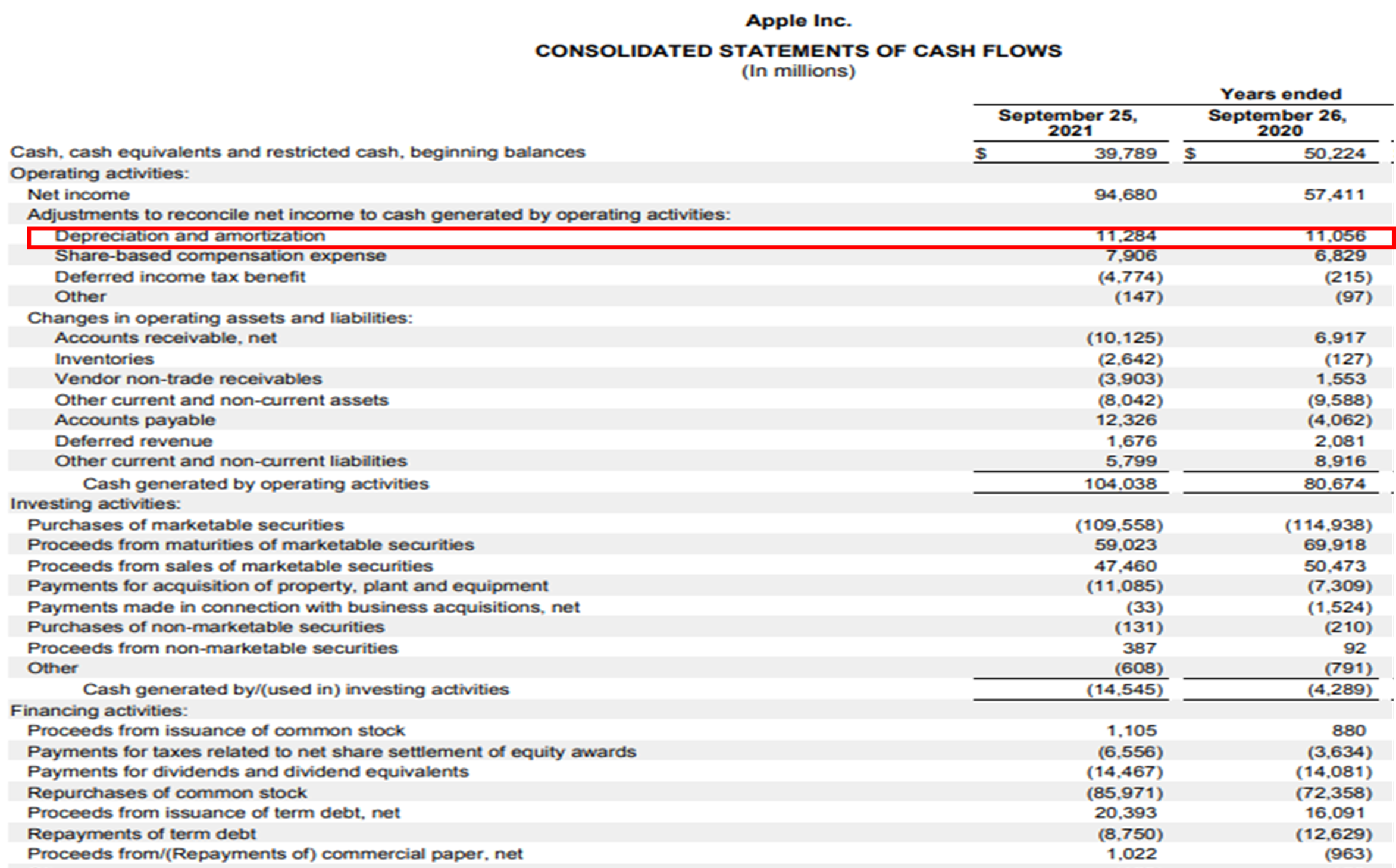

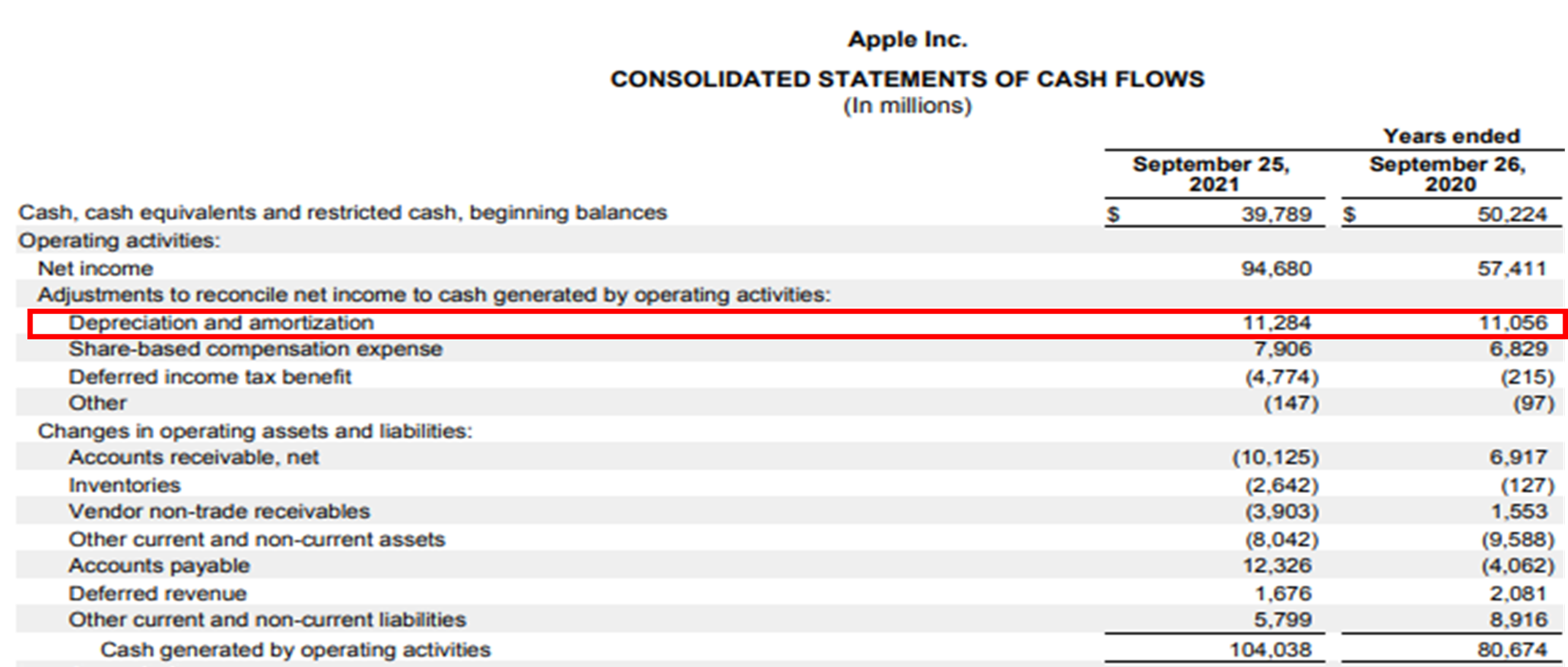

Depreciation and Amortisation is the amount written off an asset account over the life of the asset.

The amount written off in the books of accounts over the useful life of tangible (depreciation) and intangible (amortization) assets is called depreciation and amortization. It’s a non-cash expense and calculated using specific methods as prescribed by the GAAP.

Depreciation/Amortisation = Initial cost of the asset / Useful life of the asset

The Depreciation and Amortisation of Apple’s assets for the period ending September 2020 is $11,056 and $11,284 for the period ending September 2021.

Dividend Payout is the percentage of a company's profit paid out as dividends to the shareholders.

It’s the ratio of dividends per share to earnings per share. The company decides on a dividend payout depending on following factors such as:

Dividend Payout (Total Dividend)/(Net Income)× 100

Apple’s Total Dividend for the period ending September 2020 is $14,087 million and $14,431 million for the period ending September 2021.

Also, Apple’s Net Income for the period ending September 2020 is $57,411 million and $94, 680 million for the period ending September 2021.

So, its Dividend Payout can be calculated as follows:

Dividend Payout for September 2020 = ($14,087 million)/($57,411 million)×100 ≈ 24.54 %

Dividend Payout for September 2021 = ($14,431 million)/($94,680 million)×100 ≈ 15.24 %

It’s the process of buying and selling a company’s stocks on the stock exchange.

It’s the transfer of a company’s shares to the buyer of the company's stock. This process usually involves a stockbroker who acts as a liaison between the buyer, seller, and the stock exchange.

Capital Expenditure is the amount spent by a company to purchase fixed assets or increase its useful life or efficiency.

It’s the expenditure on assets that have a longer useful life. Capital Expenditure is necessary to acquire assets that are required for the company’s daily operations. Such expenses include:

Capital Expenditure = Net PPE [Change in Property, Plant, Equipment] + Current Depreciation

Apple’s Capital Expenditure for the period ending September 2021 is $13,958 million [($39,440 million - $36,766 million) + $11,284 million].

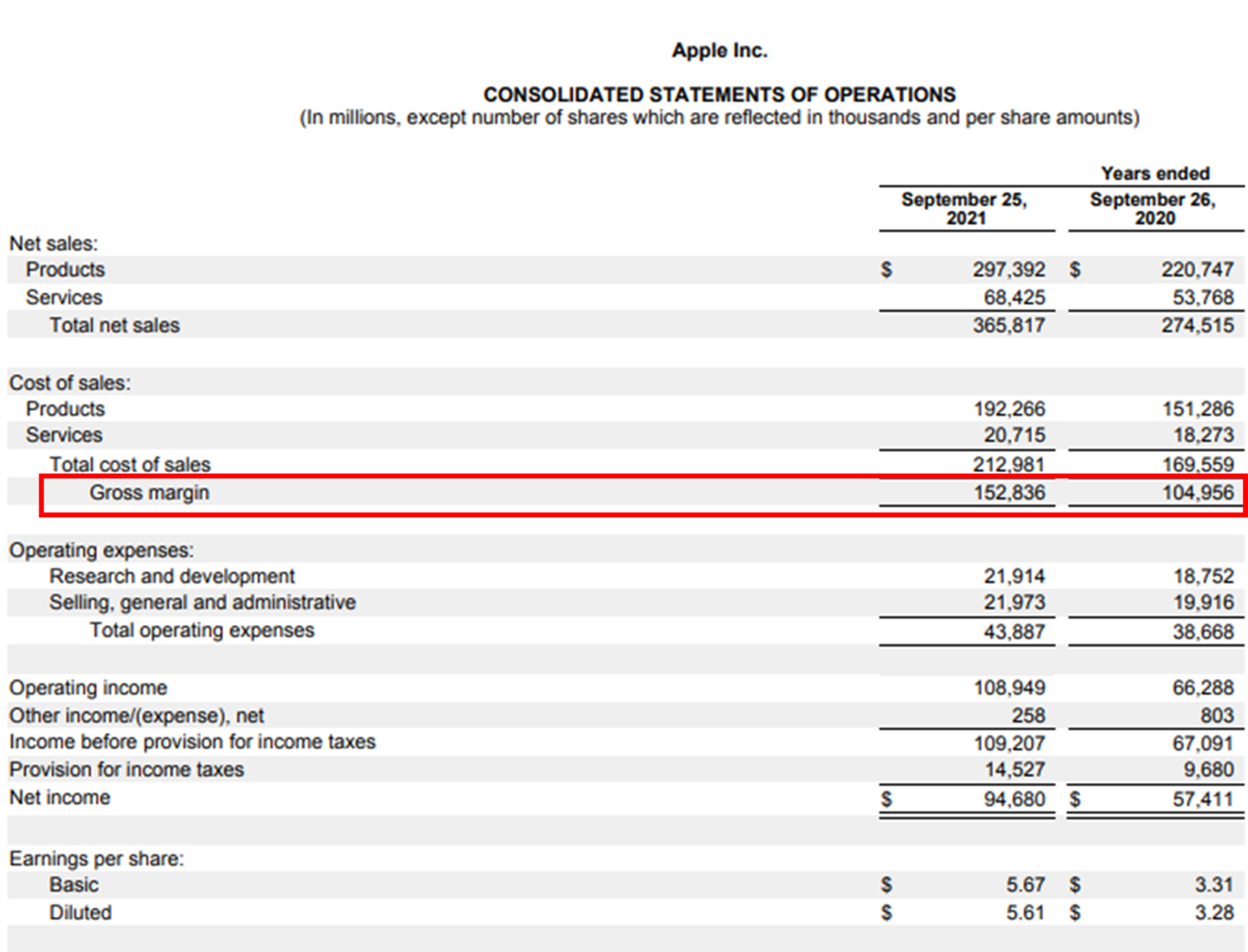

Gross Profit of a business is the total revenue from operations reduced by the cost of goods sold.

The amount as shown on the income statement after deducting the cost of making and selling goods and providing services from the total revenue from operations is called Gross Profit.

Gross Profit = Total Sales - Cost of Goods Sold

Apple’s Gross Profit for the period ending September 2020 is $104,956 million ($274,515 million - $169,559 million) and $152,836 million ($365,817 million - $212,981 million) for the period ending September 2021.

Gross Profit Margin is gross profit as a percentage of the net sales.

It’s expressed as a percentage of net sales and also known as gross margin ratio.

It’s a profitability ratio that helps understand if the sales are sufficient to cover the cost of goods sold.

Gross Profit Margin = (Gross Profit)/(Net Sales) × 100

Apple’s Gross Profit Margin for the period ending September 2020 is 38.33 %(($104,956 million)/($274,515 million)×100 % ) and 41.78 % (($152,836 million)/($365,817 million)×100 %) for the period ending September 2021.

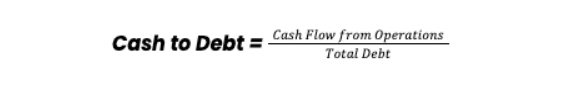

Cash to Debt is the ratio of the company's operational cash flow to its total debt.

Cash to Debt ratio is a key metric in gauging a company's ability to meet its debt obligations. It tells you how long it will take the company to repay all of its debt, assuming it allocates all of its cash flow to debt repayment.

For Apple, the cash to debt ratio is 0.72 for the year 2020 and 0.83 for the year 2021, based on the figures obtained from its cash flow statement and balance sheet.